Sales Summary Inquiries and Reports

Sales summary inquires may be made for any location and date range. Quantity values and dollar amounts are displayed for all paid, voided, and returned orders on an individual and net basis. Sales summary reports may be generated to display, print, or export this information.

Tracking

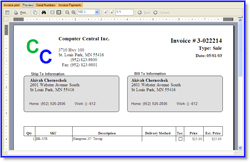

Each new quote, invoice, or sales order is assigned a unique number for easy identification and traceability.

Additional Line Items

User-defined charges, including delivery, labor, disposal, freight, and other charges (such as gift certificates) may be added as separate line items on the quote, sales order, or invoice. Order reductions, such as discounts, redemptions, coupons, rebates, and trade-ins, are also listed as line items. Depending on the customer’s tax exempt status and/or the tax configuration record assigned to the order, sales tax may also be added to the final bill.

Adding Items

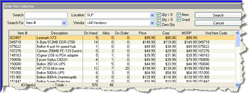

Items already in the Inventory Management System may be added to a quote, sales order, or invoice by simply entering the item number/SKU, scanning the barcode or UPC symbol, or by searching for the item number, description, or vendor’s item number. The system also displays the item quantity, its location, a text description, the type of item (regular, labor, delivery, etc), allocation numbers, delivery status, shipping information, and the requested delivery date.

When searching for item availability at the point of sale, the system displays on-order quantities, allocated quantities, and on-hand quantities for all locations. As items are selected for sale, the system automatically recommends other items that compliment, or accompany, the sale. The “top-five” items sold to individuals who previously purchased the same item are also listed. How the customer takes possession (which carries over to a sales order or invoice if the quote is approved) on these items may further be assigned with user-defined descriptions that fall into one of three categories: (1) take-along, (2) pick-up, or (3) delivery.

Payment Options

The tool allows multiple payment methods, including any combination of cash, credit card, finance, checks, gift certificates, etc. These user-selectable payment methods are entered, in addition to check numbers and dollar amount, when applicable. If necessary, additional payment methods may be defined within the system by a user with administrative rights. Customized payment terms may be tracked on specific transactions for past usage of specific payment methods. Depending on the terms of the sales order or the invoice, the tool also flags the sales representative and/or delivery person to collect deposits or prepayment amounts, payment before delivery, or payment on delivery.

Pricing

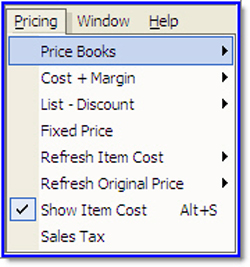

Selling prices within the system are defined according to price books. Each location is assigned a price book and multiple levels of unique pricing are allowed.

After items have been added to a quote, sales order, or invoice, the user (if assigned permission) can modify the pricing by adjusting the selling price in the following ways: discount from list on a line or order basis, cost plus margin on a line or order basis, or a fixed price with or without sales tax. Regardless of the method, the tool automatically calculates the new list price for each line on the order. Optionally, the tool can also prompt for authorization if the selling price is below a preconfigured price level.

Printing

Once the quote or sales order has been sent to a printer, the tool automatically displays a “printed” status on the screen. Quotes, sales orders, sales analysis data, invoices, and invoice status reports may also be exported to Adobe PDF or Microsoft Excel formats for electronic formatting and distribution.

Sales Tax

Multiple sales tax configurations may be defined within the system. Each location is then assigned to the appropriate configuration, with the option to override the configuration at the point of sale.

Daily Closing Check List

Each location that has sales or accepts payments must generate a closing check on a daily basis. On the check list report, cash drawer amounts and all summarized pay type amounts are displayed, as well as credit card batch numbers, batch totals, and batch invoice amounts. Values for paid and voided invoice totals, deposits, used prior deposits, and termed payments are also displayed.

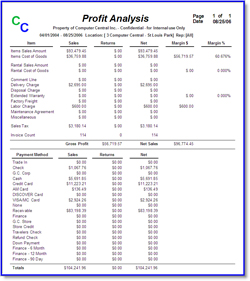

Profit Analysis

Profit analysis reports may be generated by location, for any given period of time. Profit margins and profit percentages for each item type are generated based on sales and returns. Gross sales and net sales values are also displayed, as well as itemized payment values.

Bank Deposit

Bank deposit reports may be generated as a means of viewing both itemized and total cash and check deposit amounts. Bank deposit reports may accompany bank deposit slips to ensure accurate bookkeeping and eliminate manual data re-entry.

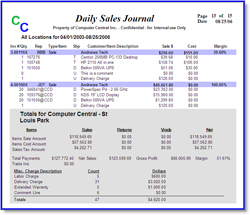

Daily Sales Journals

Daily sales journals may be generated to view the total sales values by location and associated sales representatives. Net sales, gross profits, and profit margins are displayed, as well as individual details for each line item including sales tax and items sale and cost of goods sold.